When you tell people you travel full time, you can see the cogs start turning in their head even before the question leaves their lips. They are crunching the numbers, usually imaginary numbers they’ve created based on their own conceptions of what travel costs and what it costs to run their own lives. But ultimately, this all leads to the same question:

How do you afford it?

The simple answer to this is that Aaron worked full time for several years and saved so that he could afford to travel for a long time without needing a steady income. I, on the other hand, work remotely to more or less fund my way.

The complicated answer is that we can afford it because we’ve made it affordable. One of the ways that house sitting benefits us is that it saves us a lot of money on accommodation. When we look at our figures from the past year, we can clearly see the months that we stayed in hotels and AirBnBs versus the months that we only did house sitting. The difference is staggering. Paired with budget flights, we’ve managed to keep our major expenses low.

It’s worth mentioning that we don’t track everything we spend. Things like groceries, eating out, ground transportation, cultural experiences, and so on are considered, but we don’t write down what we spend. Due to the nature of how we travel, it does seem to balance out. We might take four days to do the tourist thing in a city we really wanted to visit but where we couldn’t secure a house sit. We’ll end up paying for accommodation and also eating out twice a day, going to more bars, paying for experiences, and so on. But then we’ll move on to a house sit, eat out maybe once a week, take a break from alcohol, walk everywhere, and spend no money. Because the “tourist” breaks are often the minority, we feel comfortable with the amount we spend.

Tips for Cutting Costs

All this being said, there are a few ways we save money that can really add up over time. These include:

- Carry on only: It sounds improbable, but very often, we fly with only carry on. Sometimes, if we are flying a particular budget airline that is going to check, we’ll check one bag and split the cost. We’ll load that up with larger toiletries (another money saver) and then divide the rest of the weight between us. This is always much cheaper than checking two bags every time.

- Budget airlines: We fly budget when we can, and we have the luxury of being able to be flexible with our dates and even our locations most of the time. Usually the expensive flights are because we had to be somewhere at a certain time, and so we were forced to pay a bit more (or a lot more) than we otherwise would want to. Over the course of our trip however, these larger flights evened out when spread across the days. If I could go back to the start, I would get the Jetstar membership. If you will be flying around Asia or especially around Australia, Jetstar is going to be your cheapest bet. Not necessarily your best bet, but your cheapest. Their membership costs money, but it would’ve saved us about $100 on flights.

- Self-catering: We look for accommodation that allows for some amount of self-catering whether it’s just access to a fridge and a kettle or additional appliances like a toaster and a microwave. We try to limit our meals out to two per day and then have snacks from the grocery store in between. This saves us money even when we are in tourist mode. When we are house sitting, we’ll buy in bulk and make large batches of cheap meals that we can eat over several days. We always try to buy and eat what is local and seasonal (and on sale) to save even more.

- Walking and public transportation: Outside of Southeast Asia, we’ve probably taken less than 10 taxis or Ubers the whole year. A few of these times, it was because they were actually cheaper than the ground transportation (Brisbane…) and others because someone accidentally booked the shuttle for the wrong date…oops. But for the vast majority of our travels, we’ve relied on public transportation or simply a good pair of sneakers to get us around. This not only saves a ton of money on taxis and rental cars, but it also keeps us in good shape and allows us to see parts of a city or town that we might have missed from a car window.

- Thrifting: Even before embarking on our journey we were being thrifty. Many of the more expensive items I needed (backpack, sneakers, waterproof layer, woollen layer, hiking shoes) I bought second hand for pennies. When traveling across many different seasons, it’s common to off load certain items and get new ones. Thrifting takes the sting out of abandoning your clothes and buying a new wardrobe.

- SIMs: This is a bit of a travel hack that might not be for everyone because it’s a little fiddly, but when arriving in a country, we get the SIM card with the best introductory offer. This usually lasts a month. If we are staying longer than a month, we’ll then switch to the SIM with the next best offer, and so on. Those $5 introductory offers usually jump to $30 or more per month afterwards, but if you are on top of it, you can save a lot and keep the same number. Because we spent so long in Australia, we ended up with a cheap carrier (Lebara) that had a reasonable monthly rate once we worked our way through all the deals.

Now that I’ve covered a few tips on how we’ve pinched pennies, I’ll outline our monthly costs. Again, this is just what we’ve spent on accommodation and flights. We spent quite a lot on train travel in Japan, Intercity buses in New Zealand, and a ferry to the South Island in NZ. Eventually I’ll do blogs outlining our experiences in these different countries and I’ll include the costs of these things then.

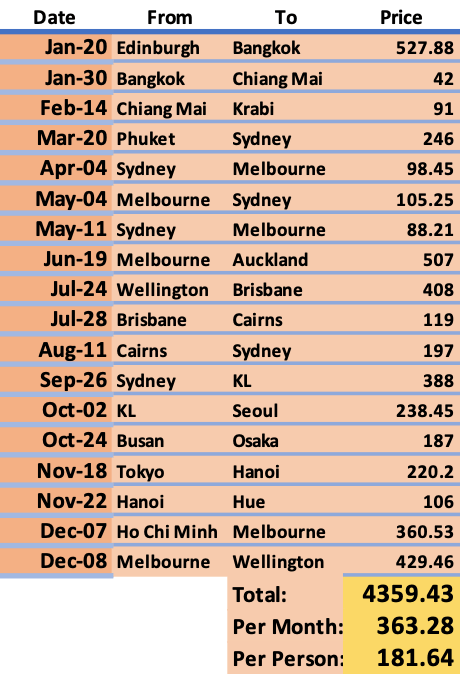

First let’s start by looking at flights:

*All costs are in GBP (£)

We did a few really long flights this year, so our flight costs are much higher than if we would’ve just stayed in Oceania, Asia, or Europe. In fact, we anticipate this cost to be much, much less for 2023, seeing as we’ll spend the first four months driving (which we will be tracking), and then we have one flight to Australia, one long flight to Europe, and then (hopefully) not too much more after that! My personal goal for next year is to spend less than £100 per person, per month.

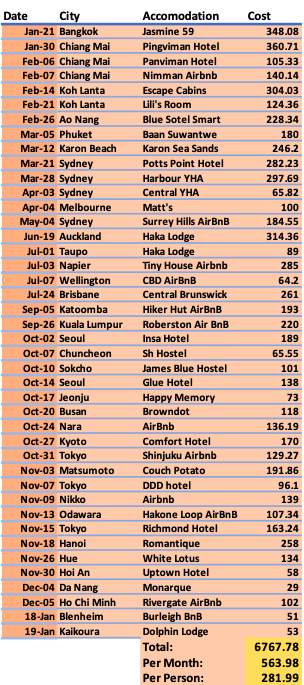

Now on to accommodation:

Now this is also higher than it maybe could’ve been for a few reasons. One, we spent the first two months of our trip not only traveling, but traveling in style. Thailand had just opened up, and the four and five star hotels were at a deep discount. Still a bit higher than we’d normally budget, but we just spent two years locked up! We decided to splurge a little and that is reflected in our overall costs.

Then, we arrived in Australia and saw quite a lot of money go to the cheapest accommodation we could find…which wasn’t all that cheap. Thankfully, our housesits started not too long after arriving, and our costs went down considerably. We did end up taking some sits out of desperation that didn’t end up being so great, and in hindsight it might’ve just been better to pay for a place, but you live and learn when it comes to what you will and will not put up with.

Our trip to NZ in the winter ended up being rather costly, and came from the necessity of a visa jump. Better planning could’ve eliminated almost £1000 from our yearly costs.

Near the end of the year we did another sit-free stretch, also in Asia. Things were a bit more expensive in Japan and Korea, so we were more mindful of our budget here than in Thailand, but we still managed to cover a lot of ground and see a ton while keeping costs pretty manageable.

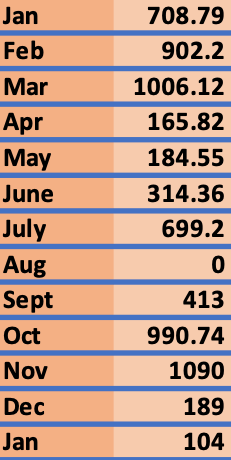

My favorite part of this chart is that it goes from July to Sept, with no charges for August at all! Below is a monthly breakdown of accommodation costs to give an idea of the difference between the months we were house sitting and the months we weren’t.

*we started on Jan 19, so this goes until Jan 19 2023

As you can see, March, October, and November were the most costly months as we did zero sits and we were in expensive countries for at least part of these months (Australia in March, Korea and Japan in October, and Japan in November). Our house sitting really started going strong in April and other than some costly accommodation in New Zealand in July, we managed to keep costs relatively low. It also helps that we are a couple, so any costs are split down the middle. Had we opted for dorm rooms or private rooms in AirBnBs, we could’ve saved even more, but at this stage there is a comfort level that we strive for, even in the priciest of locales.

Next year we are hoping to do more long-term house sits, not only to save on accommodation, but also to get a more comprehensive feel for the places we’ll be visiting. We will be spending the first third of the year in New Zealand, but hopefully our paid accommodation will be minimal. The second trimester, as it were, will be in Europe, so I’m hopeful we will be able to secure sits while also taking weekends here and there to be tourists.

In case you don’t want to do the math yourself, our total costs for flights and accommodation for a year of traveling came to £11,127.21 (give or take a few pence for exchange rate fluctuations)! To put that into perspective, our yearly rent in Edinburgh was £12,900.00, plus council tax and utilities.

My final thoughts on this is that it is, of course, just a fun exercise to see how much things cost and how we can be more mindful of certain expenses in the future. But it’s also a way to reinforce the idea that travel can be accessible and it can be affordable. Sometimes it simply requires utilizing all the resources available to you and all the skills you possess to make it work.

If you’re interested in trying out the house sitting lifestyle, be sure to check out our blog on how to get started as a pet sitter, as well as subscribing to get more insights about long term travel, housesitting, and more!

One thought on “How Much We’ve Spent in 2022”